August 12, 2024

What Sorts Of Legal Representatives Do You Need For Your Service? Figure Out Here Blog Site

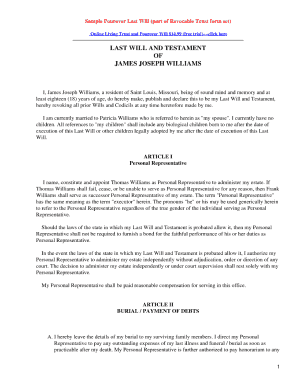

Exactly How To Make A Will Without A Lawyer: Utilize An Online Layout Discuss your decision with them ahead of time and guarantee they want to handle the responsibilities included. While developing an estate strategy is important, it is similarly important to communicate your purposes and the How to Write a Will details of your plan with your family members, organization partners, and crucial workers. Clear interaction can aid avoid misconceptions, conflicts, and conflicts among your liked ones and stakeholders. By discussing your estate strategy freely, you can provide quality on your dreams and minimize any kind of prospective uncertainty or stress.Consumer data protection and privacy - McKinsey

Consumer data protection and privacy.

Posted: Mon, 27 Apr 2020 07:00:00 GMT [source]

Make A List Of Your Possessions

Maintain referring back to your standard organization strategy so as not to lose sight of what you desired for. Your business handbook is something you will probably change and include in as your service grows. In short, it is actually a book to sum up exactly how you do things in your business.- Preparation for exactly how you will certainly manage these responsibilities is a wise move as a brand-new small business owner and will certainly enable you to concentrate your time and focus on customers as opposed to routine service upkeep.

- A freeze allows the proprietor to start moving control and to have monetary security in retired life.

- When a business owner passes away, what occurs next relies on the kind of business, whether there is a company connection plan or other kind of succession plan, and whether there is a will.

Developing Your Business Entity

This overall resets every year, and the provider pays the taxes as opposed to the receiver. This limit applies per recipient, so giving $18,000 to each youngster and different grandchildren would certainly not incur gift taxes. Unlike a firm, LLC members can take care of the LLC nevertheless they such as and go through fewer state regulations and formalities. As a collaboration, participants of an LLC record business's profits and losses on their income tax return, rather than the LLC being taxed as an organization entity. Binns states selecting the right time to carry out an estate freeze depends upon factors such as the business proprietor's age, family members account and financial resources. On top of that, a trust fund can be either optional, allowing the trustee or trustees to make a decision if, when and to whom to pay income and resources, or non-discretionary, where the trust fund document stipulates those information. Due to the individual nature of the connections in family-owned companies, a death can be disruptive and destabilizing to the workers. They will certainly be stunned and unfortunate, as you are, along with worried regarding their jobs and expert futures, particularly if the death was unforeseen. What happens with partnerships, restricted collaboration or limited liability partnerships (LLPs) relies on the partnership contract. Restricted liability firms (LLCs) are needed to have an operating agreement that includes what occurs in case an LLC owner passes away. The probate laws in many states divide residential or commercial property amongst the surviving partner and kids of the deceased. In 2024, for a legally married couple, generally each spouse would certainly have the $13.61 million federal inheritance tax exclusion. A detailed estate plan would additionally include provisions resolving what would certainly occur in case of a simultaneous death. Nonetheless you might wish to produce what's called a twin will to divide your business properties - this is not needed, and is only for the function of minimizing probate charges at the time of your passing (see next area). This content has actually been assessed by Canadian estate preparation specialists or lawyers. Our content group is devoted to ensuring the accuracy and currency of material pertaining to estate planning, on-line wills, probate, powers of lawyer, guardianship, and various other associated subjects. Our objective is to give trustworthy, updated details to assist you in recognizing these complex subjects.Social Links