Living Count On And Pour-over Will: Working In Tandem Understanding On Estate Preparation

Pour-over Wills In California The Law Practice Of Kavesh Minor & Otis, Inc Pour-over wills can aid assist in the transfer of possessions and ensure that any kind of properties you miss out on end up in your trust fund eventually. Copyright © 2024 MH Sub I, LLC dba Nolo ® Self-help solutions may not be allowed in all states. The details supplied on this site is not legal suggestions, does not comprise an attorney referral solution, and no attorney-client or confidential relationship is or will certainly be developed by utilize of the website. In some states, the info on this site might be considered a lawyer referral service.What Is A Depend On? Meaning, Account Types And Advantages

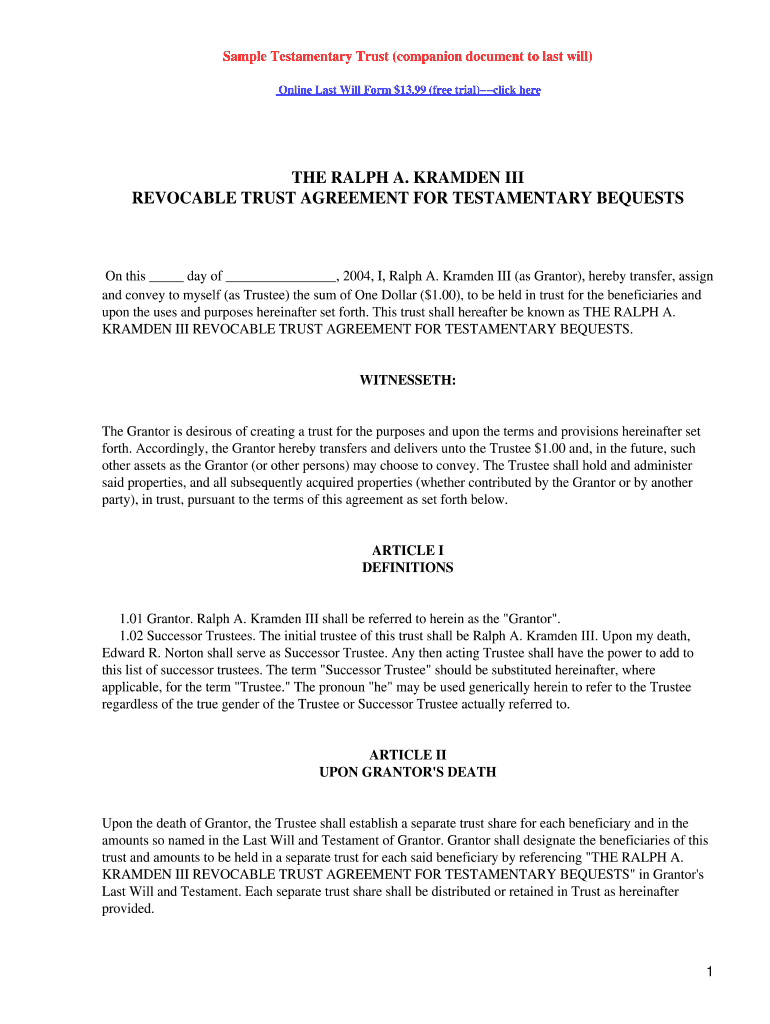

In creating your estate strategy, one option you might go after is establishing a revocable living trust fund. During your life time, you can access the assets in this kind of count on and likewise make updates to it as needed. A revocable living trust likewise helps your enjoyed ones stay clear of the lengthy process of probate when you pass away. Must you go this path, you may think about setting up a relevant file referred to as a pour-over will certainly as well. A pour-over will is a last will and testimony that acts as a safety tool to catch any properties that are not moved to or included in a living trust. While "financing" a living count on can be a simple procedure, in some cases properties do not constantly make it to the depend on for a range of reasons.Wills Causing Spills: Caution - Pour-Over Clauses are Void in B.C. - Clark Wilson LLP

Wills Causing Spills: Caution - Pour-Over Clauses are Void in B.C..

Posted: Tue, 04 Jul 2023 07:00:00 GMT [source]

Revocable Count On (living Count On)

Dealing with an Austin estate preparation lawyer is critical to developing a legitimate and enforceable pour-over will. The The Golden State Probate Code has a distinct arrangement that enables depend be developed after a pour-over will is in effect. In numerous other states, the count on would need to be developed before the will, and the testator uses their will certainly to suggest their dream that continuing to be properties be moved right into the existing count on upon their fatality.- By comparison, an irrevocable count on can not be altered other than under very uncommon circumstances.

- It's still an excellent alternative to learn about as it deserves your consideration.

- These counts on are typically known as inter vivos or revocable living trust funds.

- Pour-over wills were void at English usual law because the testator could alter the disposition of the count on at any moment and essentially carry out adjustments to the will without satisfying any kind of official requirements.

- In estate preparation, trusts provide a means to stay clear of the in some cases extensive and costly probate process when transferring assets after the grantor's fatality.

- This kind of will can additionally consist of a back-up plan, must the trust dissolve or end up being invalid.

What Are The Main Events Involved In An Irrevocable Trust Fund?

If the worth of the properties that will certainly be moved right into the https://s3.eu-central-003.backblazeb2.com/will-writing-consultation/custom-will-creation/will-lawyers/is-a-handwritten-will-legitimate-whatever-you-need-to-underst.html trust fund is valued over a particular dollar limit in The golden state, the probate procedure may still be required. That dollar restriction is readjusted for rising cost of living once in a while, however it is normally over $160,000. A pour-over will is a sort of will certainly that has a special provision to transfer specific possessions to a living trust. A will certainly of this kind is worded so regarding make up, and transfer, any kind of possessions that might have been forgotten or moved incorrectly to a depend on. Furthermore, it has actually gotten approval from attorney Gabriel Katzner, a knowledgeable estate preparation legal representative with over 17 years of lawful proficiency. So, what is the link between a pour-over will and revocable count on? After you learn about this powerful duo, you might take into consideration including them to your estate intending toolkit. Intestate succession refers to how an individual's estate will be distributed by the courts if they pass away intestate, or without a will. These properties are "put over" right into a depend be managed by a trustee, who oftentimes has already been named by the decedent long prior to their passing away. The primary drawback to pour-over wills is that (like all wills), the property that goes through them have to go through probate. That suggests that any property headed toward a living count on might obtain hung up in probate before it can be dispersed by the count on.What is the best depend stay clear of estate taxes?

. This is an unalterable trust into which you position assets, again securing them from estate taxes. A Living Will only ends up being efficient if you are identified to have a terminal disease or are at the end-of-life and when you are no more able to connect your desires. In New York State, the Living Will certainly was licensed by the courts (not by legislation )so there are no demands assisting its use. As quickly as this occurs, your will certainly is legally valid and will certainly be accepted by a court after you die. Wills do not run out. These papers simply mention your choices about what you want to take place to your property and various other interests after you die. An irreversible trust fund offers you with even more defense. While you can't customize it, financial institutions can't easily make claims versus it, and assets held within it can normally be handed down to beneficiaries without being subject to estate tax. You do not avoid probate with pour-over wills as they still undergo probate, and the depend on can not be dissolved during the probate process. While the assets that put over